Janie and Kyle are the newest people in the real estate guru market. What makes them unique? They are Canadians who are interested in partnering with people to buy US real estate. What’s their offer? How much does it cost? And is it all the real deal? Scroll down for my full J/K Real Estate Partners review.

My #1 Recommendation For Making Money Online In 2024

Janie is the one running the show when it comes to being the front face on the advertising side. In one of her most recent ads she poses the question “why invest in US real estate?”. Let’s run this ad back real quick. “Why invest in us real estate? Number one the US market allows you to cash flow. Number two you can actually leverage your money. What do I mean by that? You can buy something like this (referencing a house) put 30 35% down and actually acquire this beautiful property. Number three Banks love lending on real estate. That’s why.”

Alright, so let’s unpack her points a little bit. I like that she keeps it short and to the point unlike all the other guru’s out there. So her first point is that US real estate cash flows. This is true. After all, people wouldn’t be doing it to escape the 9-5 if it wasn’t at least possible right? Her next point is all about leveraging money. Which is basically being able to afford something you can’t based off a percentage. This too checks out. Her third point is that banks love lending to real estate.

While banks do in fact love lending to real estate, even they have their lending limits…does 2008 ring a bell anyone? Also, we’ve gotta talk about her first point. Yes real estate might cash flow, but it’s a lot less than one might think. People see $2000 cashflow advertised by gurus and investing partners all the time, but it’s misleading to say the least…

My #1 Recommendation For Making Money Online In 2024

The truth about cashflow is that it’s much closer to $250 per month per property if you’re lucky. Why? Well remember, you’re borrowing money for the property. Which means you have a mortgage…and that’s gonna take a lot of that money you’re getting back in rent. The second thing is repairs and expenses. Not all properties are going to have no issues, you will have repairs to make somewhere along the line. Next is property management, you’ll need to pay a property management company and they’ll be taking a good cut. Dwindles that 2k down pretty quick huh?

That second point means you’ll be borrowing on credit, and an individual such as yourself will only be allowed to leverage so much. Basically, you won’t be able to just walk to the bank and ask for 10 different mortgages…

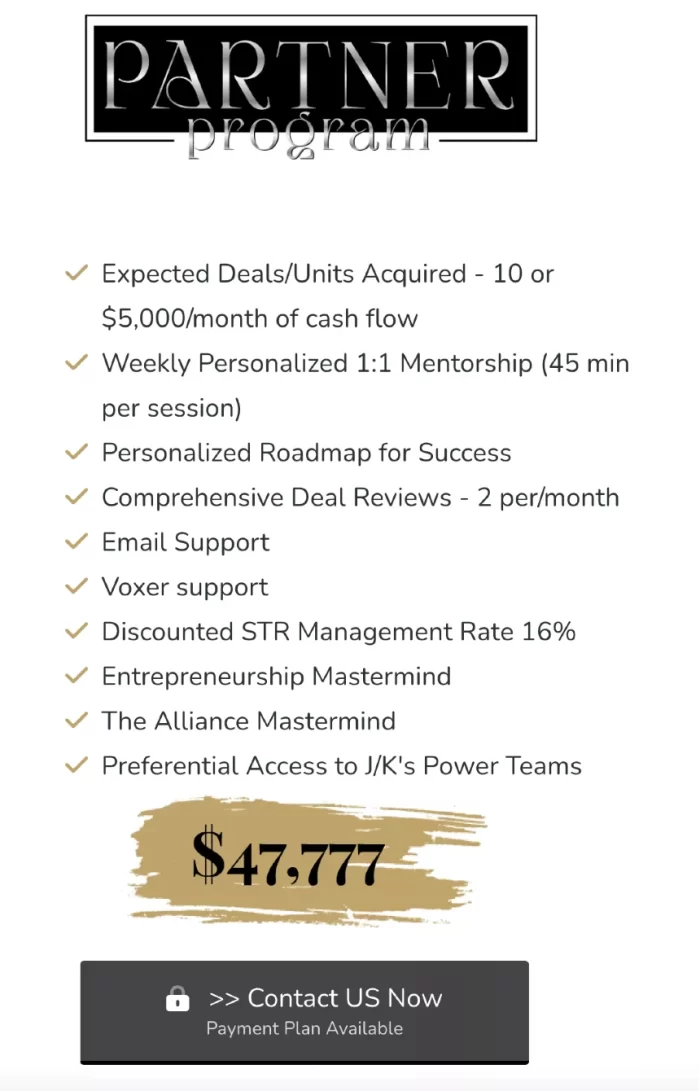

Alright, so how much does this all cost? Well the cheapest option they have is a 4 day webinar. And That’s free. The next step up from there though is $1,999 and that’s only for 8 weeks of access. Their top of the line offering? As pictured above you can see it’s listed for $47,777 or over $50,000 after taxes. That’s quite a bit when you ask me. Shoot, I mean I haven’t spent even close to that on a coaching program, and it didn’t take much capital at all to setup my little local websites. If you want a more affordable option, check out my recommendation down below.